Debt-for-Nature Swap – All You Need to Know

It is a time when the climate emergency and economic pressure are increasingly critical. The question arises: can we balance sustainability and debt simultaneously? In this case, the Debt-for-Nature Swap acts as a powerful tool in which a country’s debt is traded for the promise to protect nature. This solution is gaining a lot of popularity, especially encouraging nations to act immediately on environmental protection. In this blog, we will learn more about Debt-for-Nature Swaps and how they work.

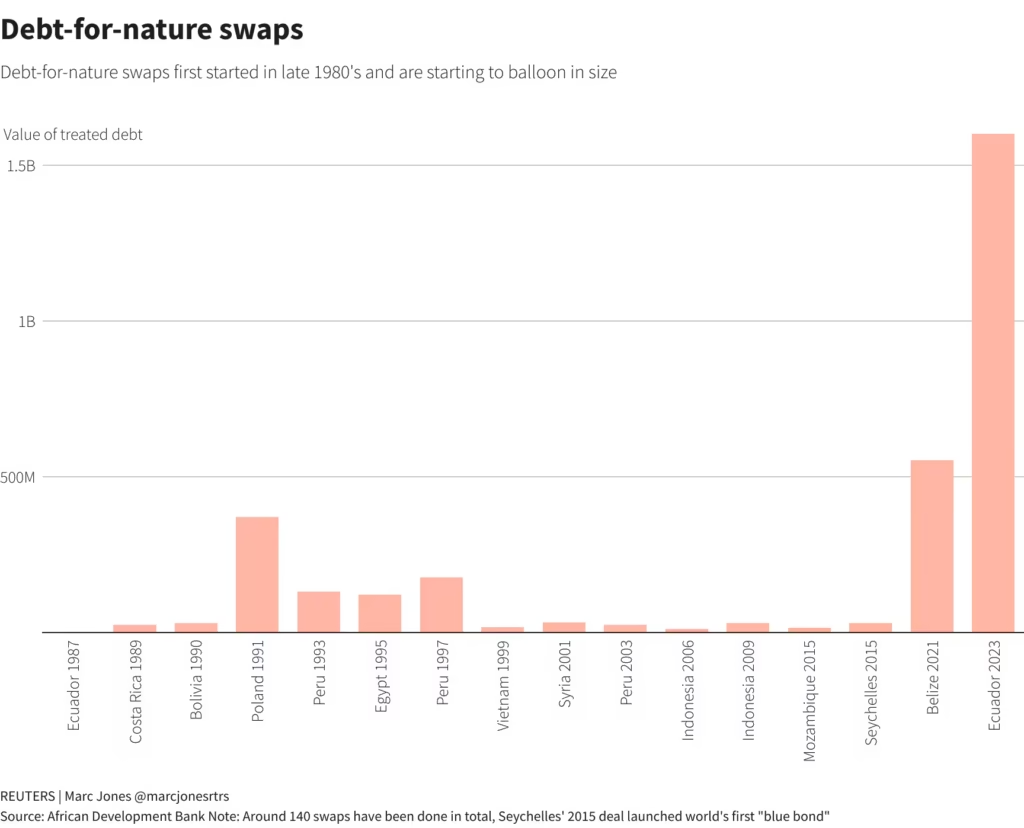

Source: Reuters

Table of contents

- What Are Debt-for-Nature Swaps?

- How Do Debt-for-Nature Swaps Work?

- Evolution of Debt-for-Nature Swap Today

- How Are Debt-for-Nature Swaps Different from Carbon Offsets?

- Key Participants

- Benefits of Debt-for-Nature Swaps

- Why Are Debt-for-Nature Swaps Important Now?

- DNS and UK Green Finance Strategies

- Why Should UK Businesses Care About DNS?

What Are Debt-for-Nature Swaps?

A Debt-for-Nature Swap is a financial agreement where a portion of a country’s external debt is forgiven or restructured in return for investment in conservation projects such as reforestation, marine protection, or biodiversity preservation. First pioneered in the 1980s in Latin America, DNS have since been applied globally, particularly in countries rich in biodiversity but burdened by unsustainable debt.

How Do Debt-for-Nature Swaps Work?

-

Debt Restructuring – Creditors (often foreign governments or financial institutions) agree to reduce or refinance debt at a discount. NGOs or development banks may act as intermediaries.

-

Conservation Agreement – The debtor country commits to funding environmental programmes, often through local conservation trusts.

-

Implementation and Oversight – Independent bodies ensure that funds are directed to tangible conservation outcomes, such as habitat restoration, national parks, or renewable energy projects.

Case Study: In 2023, Ecuador restructured $1.6bn of debt into the world’s largest marine conservation swap, protecting the Galápagos Islands (source: The Nature Conservancy).

Evolution of Debt-for-Nature Swap Today

The new deals in DNS are more streamlined and blend with financial plans, where public funds are used to attract private capital and credit enhancement tools are introduced. These include political risk insurance and reducing investor risk. These financial instruments broaden the applicability of DNS and make it more acceptable. The maturing of DNS highlights the growing role of climate finance goals and compliance with Sustainable Development Goals.

How Are Debt-for-Nature Swaps Different from Carbon Offsets?

While both aim to tackle environmental challenges:

-

DNS – Restructure sovereign debt while investing in conservation. Broader economic and ecological impacts.

-

Carbon Offsets – Market-based credits purchased to “offset” emissions. Narrower, focused mainly on emissions reduction.

DNS are increasingly viewed as a more systemic solution, addressing governance, debt sustainability, and biodiversity.

Key Participants

-

Debtor Governments – Countries in debt distress.

-

Creditors – Foreign governments, development banks, or bondholders.

-

NGOs – Facilitate negotiations and conservation implementation.

-

Local Communities – Benefit from sustainable development and conservation funding.

Benefits of Debt-for-Nature Swaps

-

Provides debt relief for struggling nations.

-

Protects biodiversity hotspots and ecosystems.

-

Enhances climate resilience (forests, wetlands, marine reserves).

-

Supports local community development.

-

Contributes to global conservation and climate goals.

Why Are Debt-for-Nature Swaps Important Now?

Over 60% of low-income countries today are in debt distress. However, these countries are also home to some of the world’s richest biodiversity. DNS help these countries relieve part of the burden by linking economic finance with climate finance and offsetting some debt through sustainable efforts and contributions towards ecological balance.

Climate change, biodiversity loss, and economic stability are interconnected, and DNS as a tool helps address these challenges. Moreover, with new sustainable policies and regulations in the market, DNS helps achieve Sustainable Development Goals for the nation.

DNS and UK Green Finance Strategies

The UK has been steadily weaving nature and climate into its economic fabric. While Debt-for-Nature Swaps are not currently part of domestic fiscal policy, they resonate strongly with the UK’s growing emphasis on green finance and global environmental leadership. And as the UK edges toward its Green Taxonomy, aligning investments with nature-positive impact will become not only desirable, but necessary.

In practice, this means that UK companies – particularly those in finance, insurance, and supply chain management – can engage with DNS as part of a broader risk and reputation strategy. Whether through investing in DNS-linked bonds or partnering with global NGOs, businesses can stay ahead of ESG trends while actively supporting climate-vulnerable nations.

- Green Finance Strategy: Emphasises nature-related financial disclosures.

- TNFD & SFDR alignment: DNS investments can help UK firms meet upcoming regulatory and reporting requirements.

- British International Investment (BII): UK government’s development finance arm actively funds sustainability-linked instruments – DNS could be a future priority.

Why Should UK Businesses Care About DNS?

With increasing complexity in ESG regulation and sustainable funding, DNS offer a tool for growth by engaging in national and global efforts towards environmental conservation.

- UK financial institutions can invest in DNS-backed bonds

- Many companies and SMEs contribute individually or co-fund DNS projects, which later also align with ESG reporting

- For businesses with global supply chains, DNS is a good opportunity to act responsibly and mitigate long-term operational risks

- DNS strategies help businesses revamp their policies and innovate in sustainable finance

Final Thoughts

As we stand at a crossroads of ecological urgency and financial innovation, DNS offer more than just a technical fix—they represent a hopeful blueprint for collective action. For UK businesses, the call is clear: sustainability is no longer peripheral—it’s strategic. By engaging in DNS, companies aren’t just managing risk or meeting ESG targets; they’re helping rewrite the story of global finance to include nature as a stakeholder. Whether through investment, partnerships, or policy influence, there’s space at the table for purpose-driven businesses ready to shape a greener, more resilient future.

FAQs on Debt-for-Nature Swaps

What is a Debt-for-Nature Swap?

A financial arrangement where part of a country’s debt is forgiven in exchange for funding conservation projects.

_

How do Debt-for-Nature Swaps work?

Creditors restructure debt, debtor countries commit to conservation, and local trusts manage funds.

_

How are DNS different from carbon offsets?

DNS focus on debt relief plus biodiversity protection, while carbon offsets deal only with emission reductions.

_

Which countries have implemented DNS?

Examples include Ecuador (Galápagos), Belize (marine reserves), and Seychelles (ocean protection).

_

Why should UK businesses care?

DNS align with UK’s green finance policies, ESG reporting obligations, and sustainable investment opportunities.

_

Do DNS support international climate goals?

Yes, they contribute to the Paris Agreement, SDGs, and biodiversity frameworks.